We expect to raise our fair value estimate for Lululemon stock, but still rate it as overvalued.

lululemon Launches Centre for Social Impact to Further Advance Equity in Wellbeing

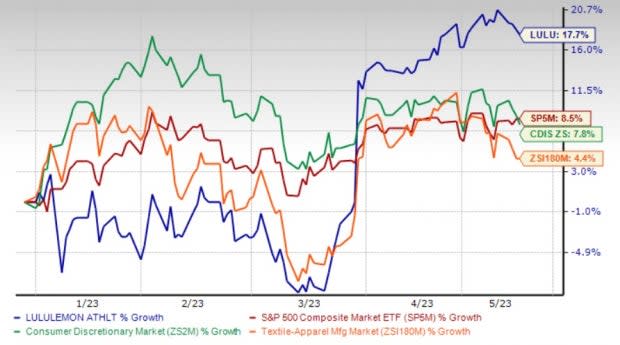

Here's Why Investors Should Hold lululemon (LULU) Stock for Now

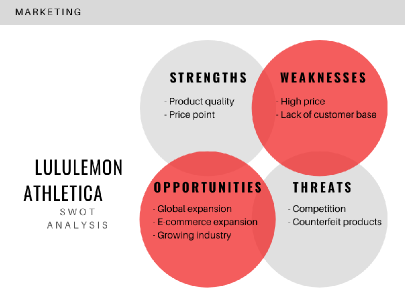

15.5 Putting It Together: Marketing Plan – Introduction to Marketing II (MKTG 2005)

Joe Girard on LinkedIn: Lululemon Earnings: Strategic Moves and Brand Strength Overcome Economic…

Joe Girard on LinkedIn: I think one of the things i've heard years and years ago, especially when…

Solved 2) How strong are the competitive forces confronting

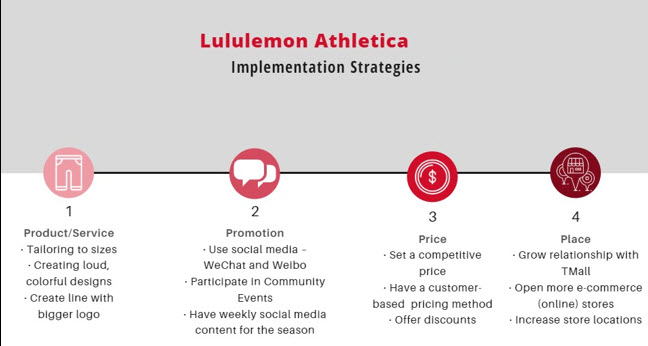

Lululemon Athletica Brand Audit

Lululemon Business Model - How Lululemon Makes Money?

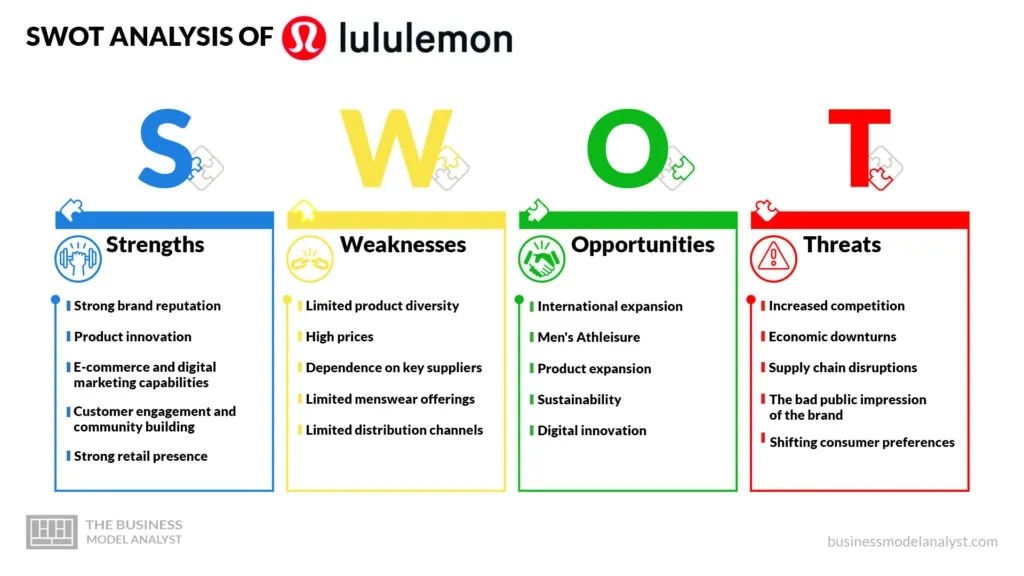

Lululemon SWOT Analysis - The Strategy Story

Lululemon Product Information Security International Society of Precision Agriculture

15.5 Putting It Together: Marketing Plan – Introduction to Marketing II (MKTG 2005)

Lululemon Athletica shares tumble after retailer issues profit warning

Doing Capitalism Better: Cotopaxi CFO Gary Bowen - Datarails