A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Tax, Accounting and Startups — Difference between Foreign Currency

20 Best Accounting Books of All Time - BookAuthority

Chapter 1 Introduction to Accounting and Accounting Systems Part - I

Foreign currency account balances in Wave – Help Center

formdrsa_001.jpg

FINANCIAL ACCOUNTING FINAL EXAM

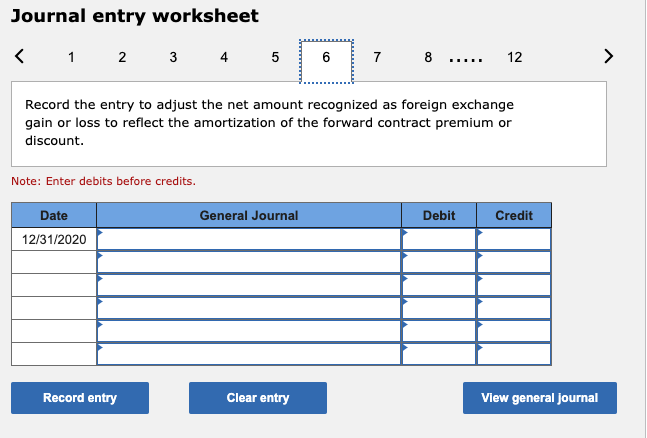

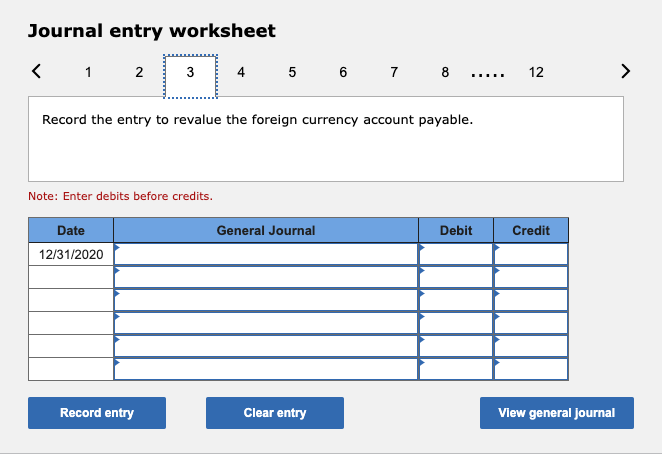

Solved Journal entry worksheet Record the foreign exchange

Solved Journal entry worksheet Record the foreign exchange

Explanation for Delta Logic in Foreign Currency Re - SAP Community

An OeDBTR illustration of ontology primitives of a business

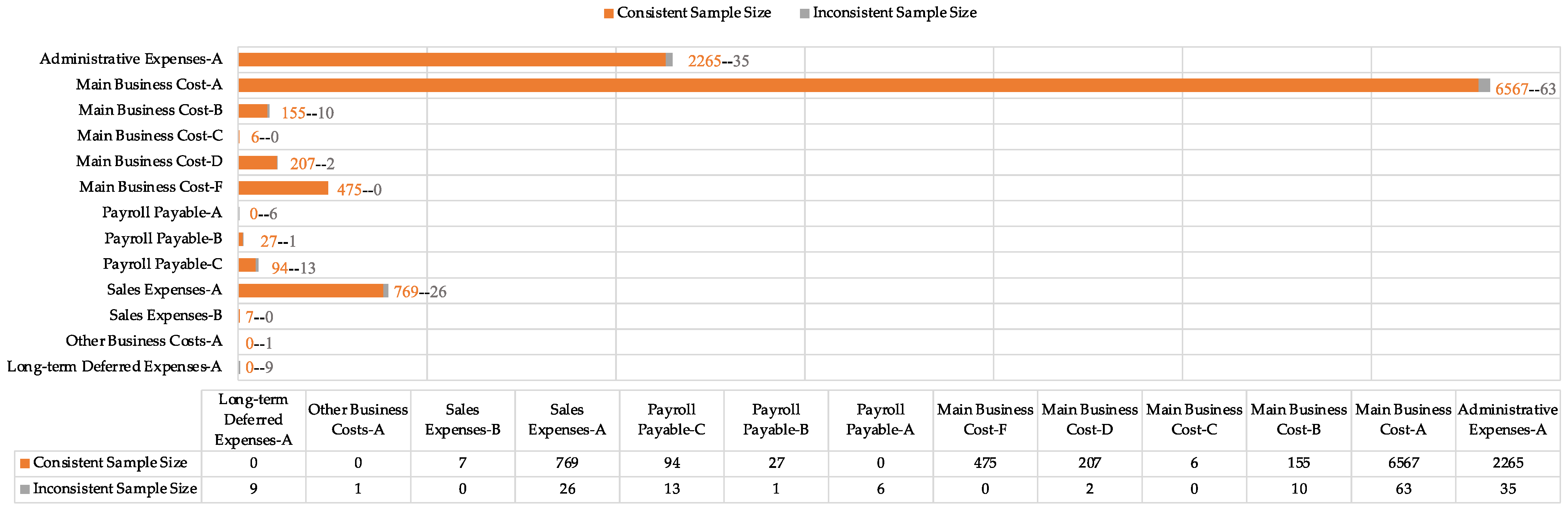

Sustainability, Free Full-Text

Deposit Accounting - What Is It, Types, Accounting Entry

Oracle Payables User's Guide

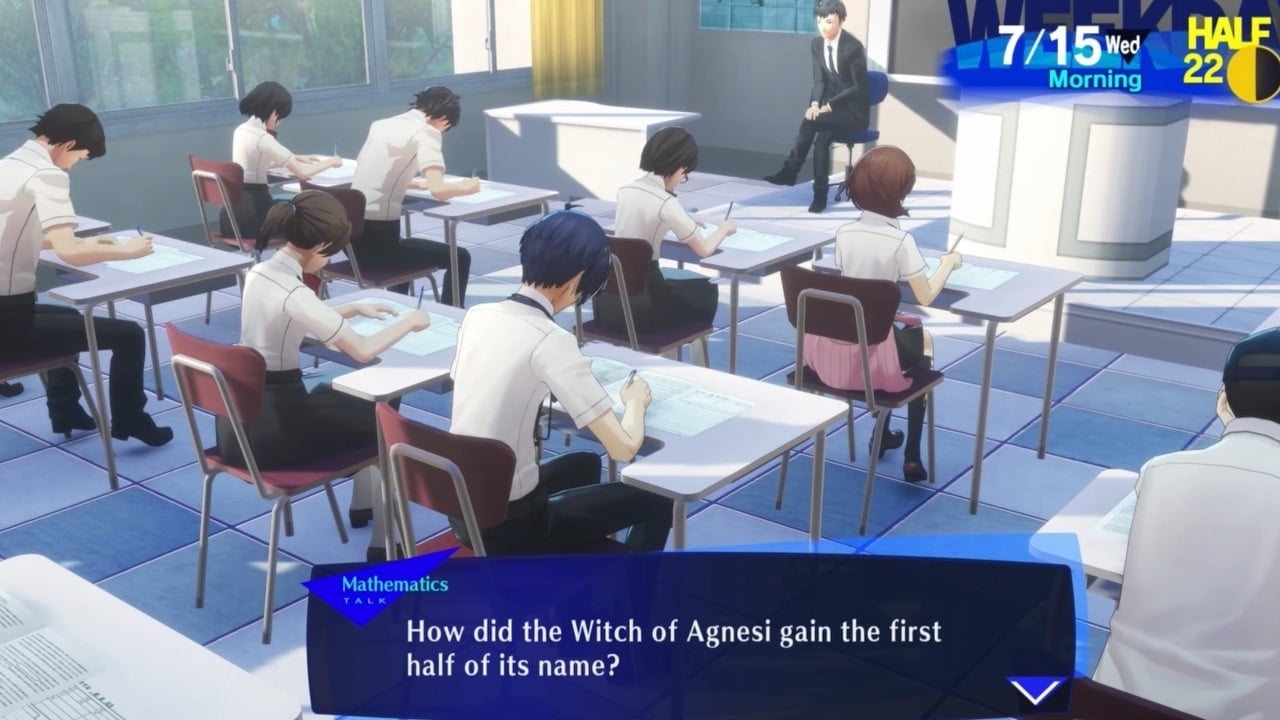

Advanced Accounting Foreign Currency Transactions