lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

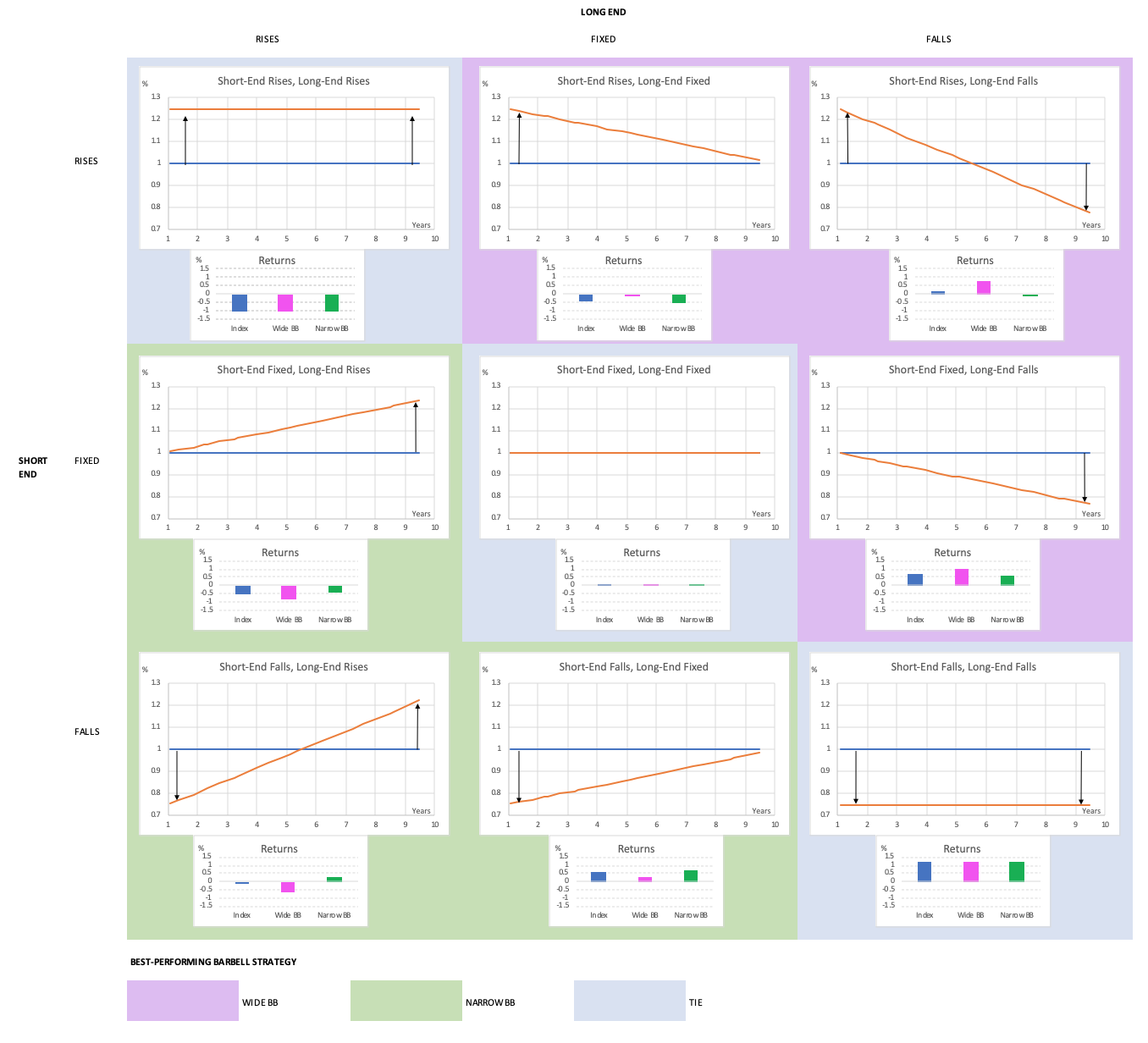

Riding the Yield Curve and Rolling Down the Yield Curve Explained

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Mastering Carry Roll-Down with Leverage, by Secured Finance Official, Secured Finance

Yield Curves – Financial Management for Small Businesses, 2nd OER Edition

R code snippet : Transform from long format to wide format

Riding the Yield Curve and Rolling Down the Yield Curve Explained

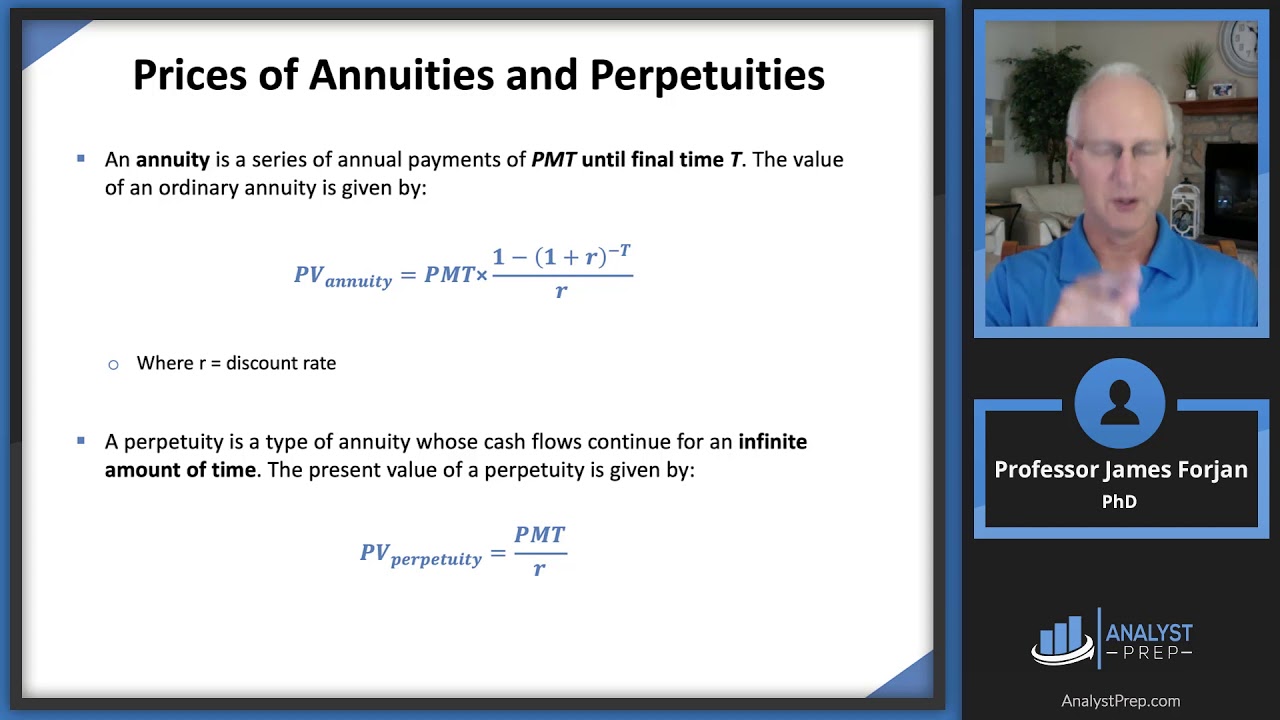

Returns, Spreads, and Yields AnalystPrep - FRM Part 1 Study Notes

Roll down yield on upwards sloping YC : r/CFA

Brazilian Yield Curve